August 21, 2020

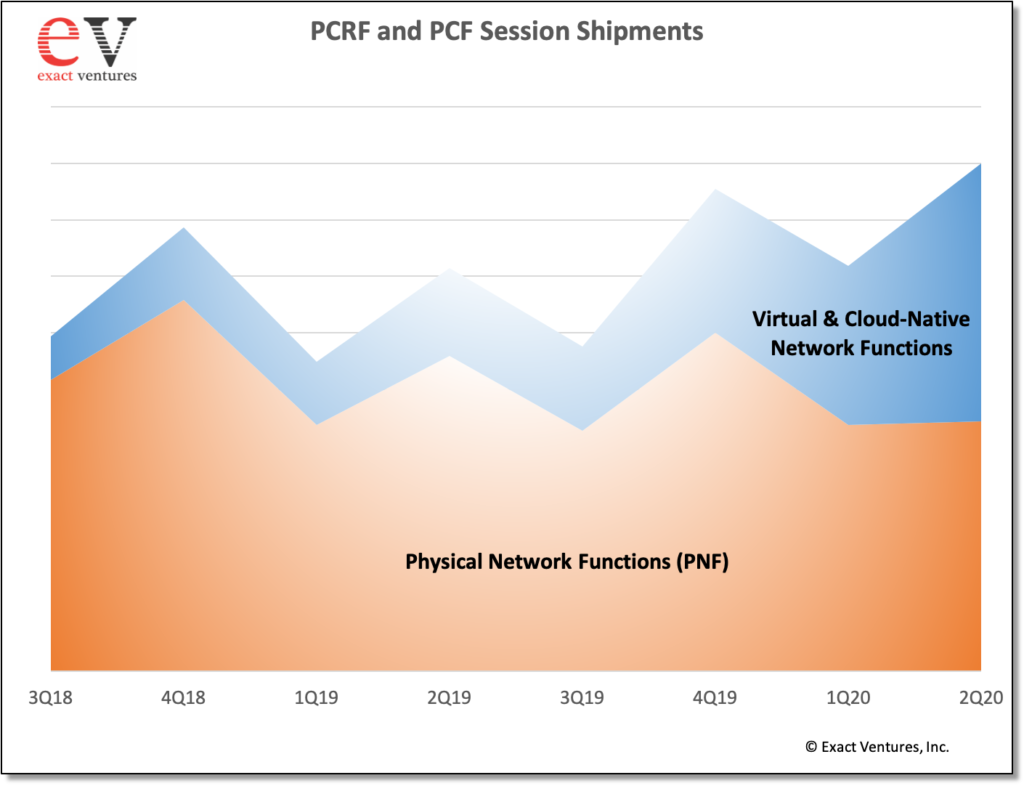

In 2Q20, the total market (PCRF + PCF) grew 15% sequentially and 7% versus 2Q19. We believe that approximately 15% of the market was due to initial sales of 5G PCF in China. In 2Q20, over half of PCRF session shipments were of virtual- and cloud-native-based network functions.

Despite the pandemic and economic uncertainty, the policy market has remained strong. The pandemic has cemented and increased the need to prioritize different types of network traffic to preserve network resources across both wireline and wireless networks. Network traffic—voice, data, and messaging—has increased due to the pandemic. Operators continue to invest in VoLTE, which typically requires PCRF sessions to assure that the voice traffic is appropriately prioritized across the network, and operators are increasingly investing in PCF licenses for 5G standalone (SA) networks. We are forecasting that the total market will increase 11% for the full-year 2020. The market could be even larger depending on the timing of 5G-based PCF revenues, which is hard to predict for reasons mentioned above and due to complex and stringent revenue accounting and product acceptance rules.

For more information please contact: info@exactventures.com

Get in touch