May 25, 2023, Burlingame, California, USA

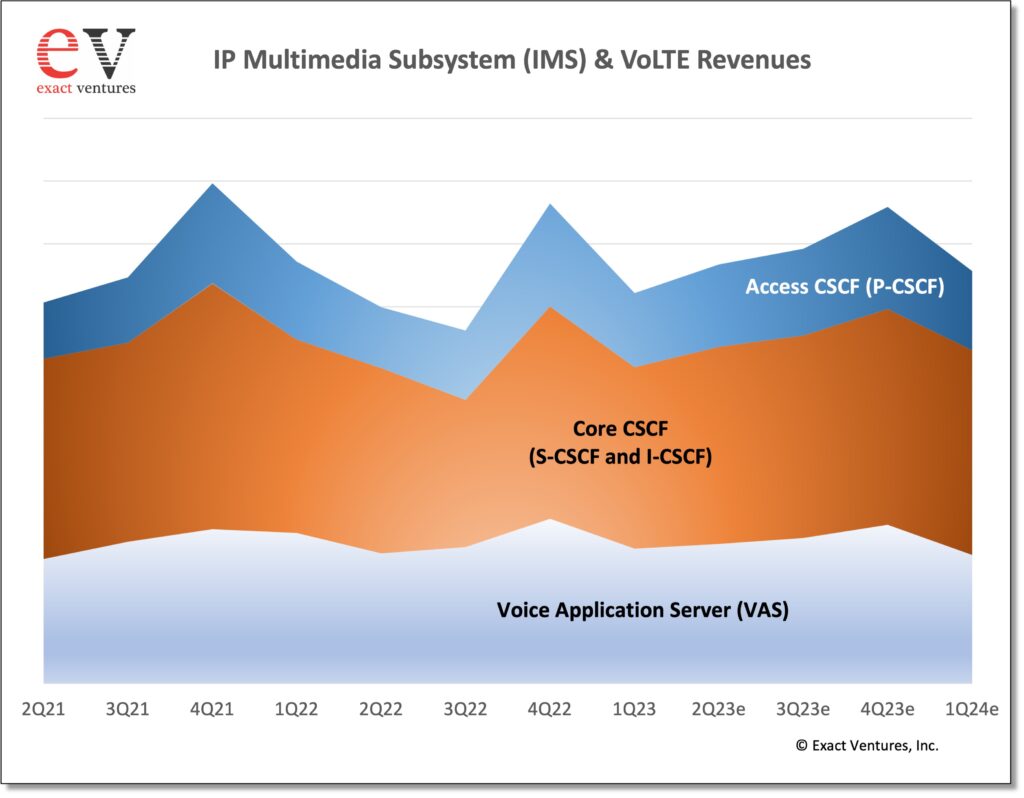

During the quarter, the total IMS/VoLTE infrastructure market fell 16% sequentially to $503 million due to seasonal spending patterns. The market was down 8% compared to 1Q22, due to order volatility in North America with IMS voice applications servers (VAS) and CSCF network functions in Asia Pacific. The overall market continued to be dominated by the wireless-VoLTE segment, which accounted for 93% of the total market, even with 1Q22. Operators continued to invest in IMS and VoLTE to prepare for 5G services, to modernize legacy equipment and voice services, and, to a lesser extent, to cope with higher voice and messaging traffic. For the full-year 2022 the market contacted by 2% to $2.1 billion as VoLTE deployment growth slows somewhat after a strong 2020 and 2021, and price erosion partially offsets growth in session license shipments. Given the aforementioned trends, we continue to expect that growth will resume in 2023 to 4% and that the market will reach $2.2 billion for the year.

In 1Q23, Nokia edged Huawei for leadership in the IMS/VoLTE market. They were followed by Ericsson, Mavenir, and ZTE, respectively.

For more information or to purchase the report, please contact: sales@exactventures.com or call +1 650 242-0080.

Get in touch