At Exact Ventures, we are currently putting the final touches on our 3Q23 vendor market share analysis and turning our sights to the outlook for the remainder of 2023 and beyond. We have been getting more and more questions about the outlook for core networks given the difficulties at the network functions vendors which have reducing revenue expectations and have announced restructurings. Looking deeper, it is important to separate the trends, and more importantly the timing of the trends, happening with 5G RAN versus the trends that are happening in the core networks.

With 5G NR, many operators chose to rely on non-standalone (NSA) topologies and thus leverage their existing evolved packet core (EPC.) So 5G RAN upgrades did not see the usual, associated core network upgrades. It was the intent of the 3GPP to not make the 5G upgrade too burdensome and expensive for network operators.

Given the above, core and RAN sales are increasingly not happening as part of the same RFP and sales process. And thus, compared to prior upgrade cycles, RAN and Core sales teams at networking vendors are different.

Now that many 5G NR networks have been built, and operators have not seen a revenue increase associated with 5G access, they must now invest in core networks and cloud infrastructure to enable the industry and enterprise use-cases that will help drive top line growth.

Similarly, there is a need for greater efficiency and automation so operators must now turn to the core network to refresh the infrastructure and network functions that supports older applications as well as to enable cloud-native, automated, and programmable networks.

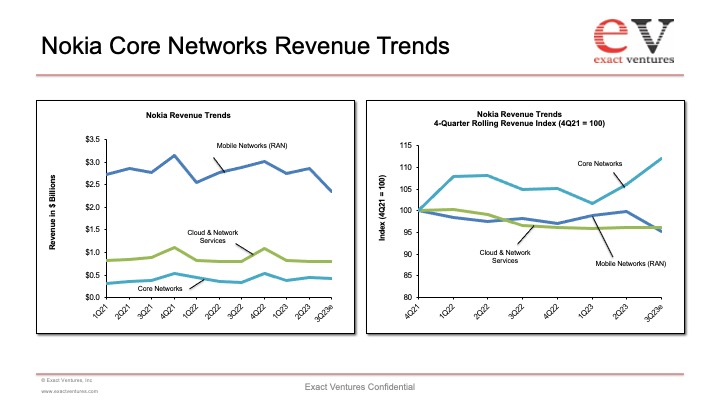

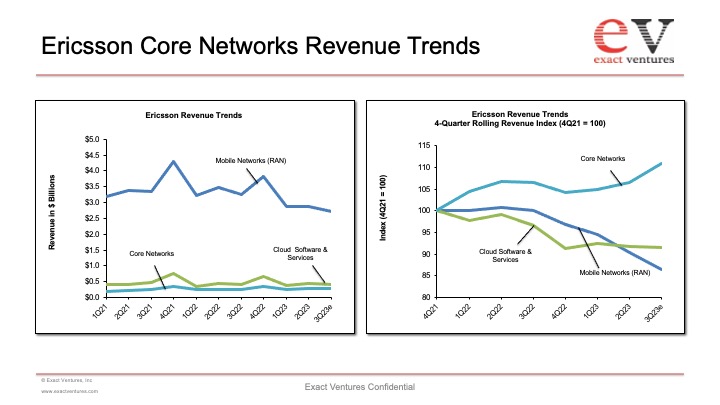

While during the revenue ramp associated with 5G RAN, mobile network revenue growth outpaced that of core networks, in recenue quarters we have seen the reverse. At Nokia and Ericsson core networks (packet core, policy, voice core, and signaling) have outperformed mobile networks (RAN) as well as the divisions that houses core networks. For Nokia, it is Cloud & Network Services (CNS) and Ericsson it is called Cloud Software & Services (CSS). You can see from the charts below that on an absolute basis, core network revenues have shown good growth in aggregate over the past 10 quarters. Looking at revenues on 4-quarter rolling basis, and using 4Q21 as a baseline, the trend is even more apparent: core networks have been growing on an absolute basis while RAN access has been contracting:

Clearly there is currently some (ok perhaps a lot) of disillusionment in wireless industry surrounding 5G. Despite billions spent on spectrum and infrastructure, revenues have hardly budged. And now that the initial surge in spending on 5G RAN has subsided, where does the industry go and what are vendors to do? While the industry is–predictably–starting to discuss 6G, there is still much work to be done on refreshing and reinventing operator core networks which will help to drive positive revenue momentum in the coming quarters and years.

Get in touch