September 1, 2023, Burlingame, California, USA

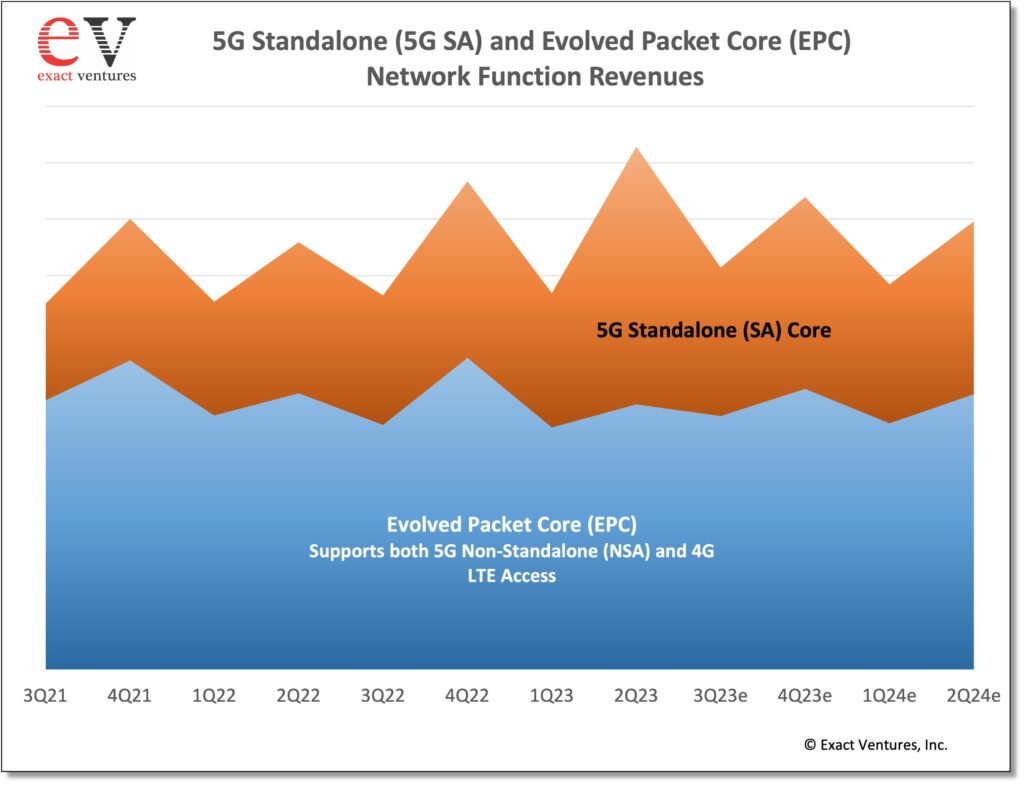

While in recent quarters growth in the 5G RAN market has stalled, operators have begun to increase investments in 5G Core to help prepare their networks for the advanced 5G use-cases to help drive 5G-related revenues. In 2Q23, the total 5GC and EPC market rose 39% sequentially due to both seasonal factors and greater-than-expected 5G Core sales to China. The market was up 22% versus 2Q22, as 71% growth in 5GC revenues more than offset a 4% drop in EPC sales. During the quarter, China accounted for 42% of the worldwide revenues for the combined EPC and 5GC markets, which is up from approximately one-third of the market in the same quarter of 2022.

As we have mentioned in the past, 5G SA core networks at scale are still limited to a relatively few number of network operators, thus recognized revenues of 5G core network functions will remain volatile due to complex and stringent revenue accounting and product acceptance criteria.

As a result of the greater-than-expected results in 2Q23, we have increased the full-year forecast for the market. Specifically, we forecast that in 2023 the total market will grow 7% as 28% growth in 5GC revenues is able to offset a 4% decline in EPC sales. We expect that for the full-year 2023, 5GC revenues will account for 41% of the total market, up from 34% in 2022.

The 5G Standalone core market leaders in 2Q23 in order are: Huawei, Ericsson, Nokia, and ZTE. While other vendors, notably Cisco, Mavenir, and Samsung, are important vendors in the market, no other vendor had more than 5% of the market on a revenue basis during the quarter.

For more information or to purchase the report, please contact: sales@exactventures.com or call +1 650 242-0080

Get in touch