June 1, 2023, Burlingame, California, USA

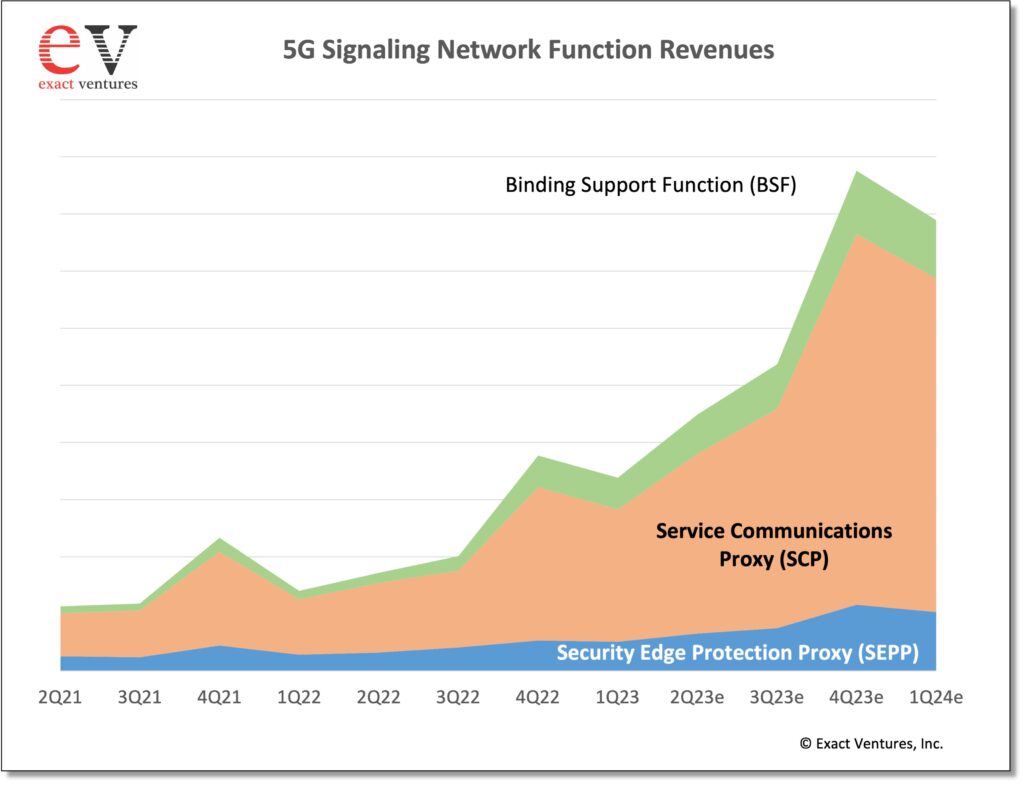

Exact Ventures recently reported that in 1Q23, the total 5G Signaling network function market (including related services revenues) was $44 million, more than double the level achieved in 1Q22. The market was down slightly on a sequential basis due to seasonal factors. During the quarter, SCP network functions accounted for 68% of the total 5G signaling network function market as operators in North America and Asia Pacific are continuing to invest in their signaling infrastructure to protect against signaling storms potentially downgrading service and/or crashing the network, simplify their signaling topology, secure the signaling traffic within the network, and protocol normalization, which is especially important for multi-vendor networks. While the SCP market has begun to materialize in China, it is still nascent as the operators continue to test and plan for Model D SCP topologies in the coming quarters.

In 1Q23, the BSF network function market accounted for 15% of the market and will likely be slower to develop than the SCP market because the BSF is especially critical for session binding for native 5G voice or voice-over-NR, which is still a few years from becoming mainstream. The SEPP network function market accounted for the remaining 16% of the market, which was even with 4Q22. SEPP sales are expected to surge in the coming years as 5G roaming because more prevalent. We forecast that the total market (network function and related services) will reach $290 million in 2023 as operators increasingly invest in standalone (SA) 5G core networks, albeit at a slightly slower pace than previously forecasted. The reason for the tempered expectations is due to: slower 5G SA uptake overall as operators continue to evaluate and invest in their cloud-native environments and processes being especially careful with signaling infrastructure due to its mission critical nature and as they search for revenue opportunities directly associated with a 5G SA core.

In 1Q23, Oracle remained the market share leader with strength in North America, Europe, and Asia Pacific. Huawei was the second largest vendor with strength in China and Middle East and Africa. Ericsson and Nokia, respectively, were the other leading vendors during the quarter.

For more information or to purchase the report, please contact: sales@exactventures.com or call +1 650 242-0080.

Get in touch