May 23, 2023, Burlingame, California, USA

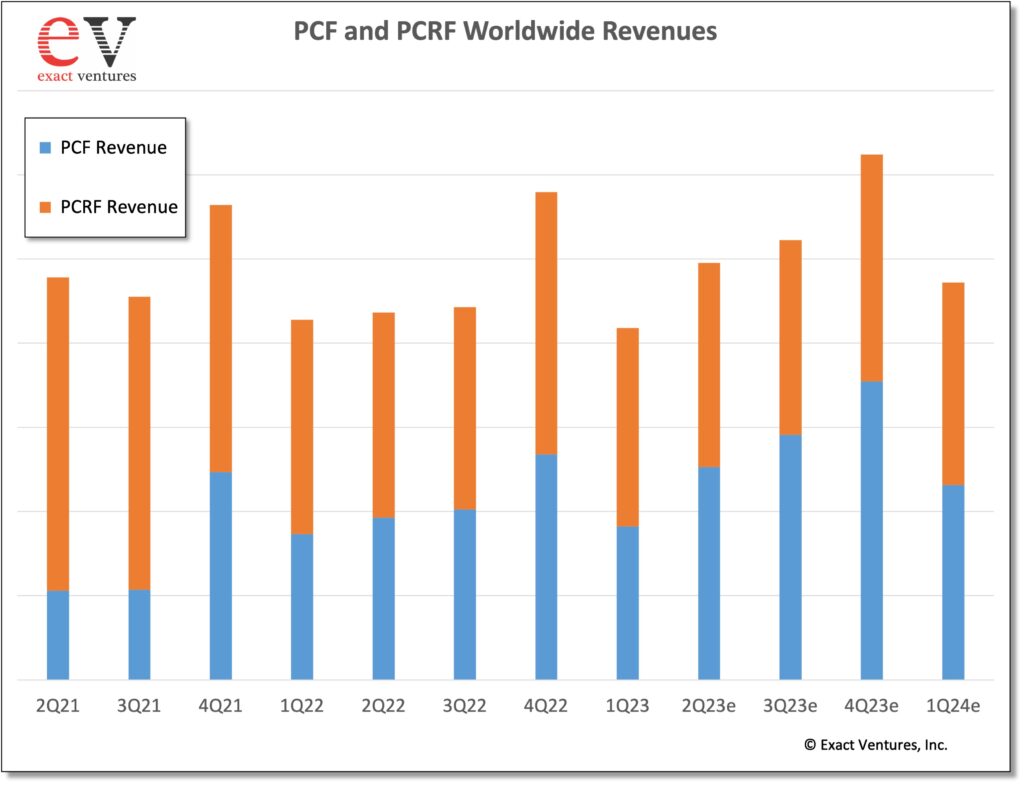

In 1Q23, the total policy network function market (PCRF + PCF) fell 28% sequentially—but was down 2% versus 1Q22. The quarter-over-quarter decrease was due to seasonal spending patterns. During the quarter, 44% of the total market was comprised of PCF revenues, with 53% of those PCF revenues coming from Asia Pacific and in particular, China, which accounted for 36% of the total PCF market. China’s influence on the overall PCF market is waning as other regions catch-up with their 5G Standalone (SA) investments. In 1Q22, China accounted for 70% of the total PCF market.

The year-over-year decrease was due to softness in 3G/4G PCRF sales which were partially offset by a 5% increase in 5G PCF revenues. While the market is in the early stages of transitioning to PCFs, the PCRF market also continues to transition away from legacy, appliance-based PNFs to virtual and cloud-native network functions. In 1Q23, 71% of PCRF session license shipments were of virtual- and cloud-native-based network functions, with the remaining 29% destined for legacy, PNF systems. While it is clear that most operators would like to transition their network functions to cloud-native, the transition has been gradual. We believe that the majority of non-PNF session licenses are still VNFs as many operators continue to invest and trial their cloud-native environments and are still determining how they plan to transition their 4G (and 3G) network functions to cloud-native.

The leaders for the combined PCRF and PCF market in 1Q23 in order were: Huawei, Nokia, Ericsson, Oracle, and ZTE. During the quarter Ericsson, Nokia, Oracle and Amdocs gained market share versus 1Q22.

For more information or to purchase the report, please contact: sales@exactventures.com or call +1 650 242-0080.

Get in touch