May 24, 2023, Burlingame, California, USA

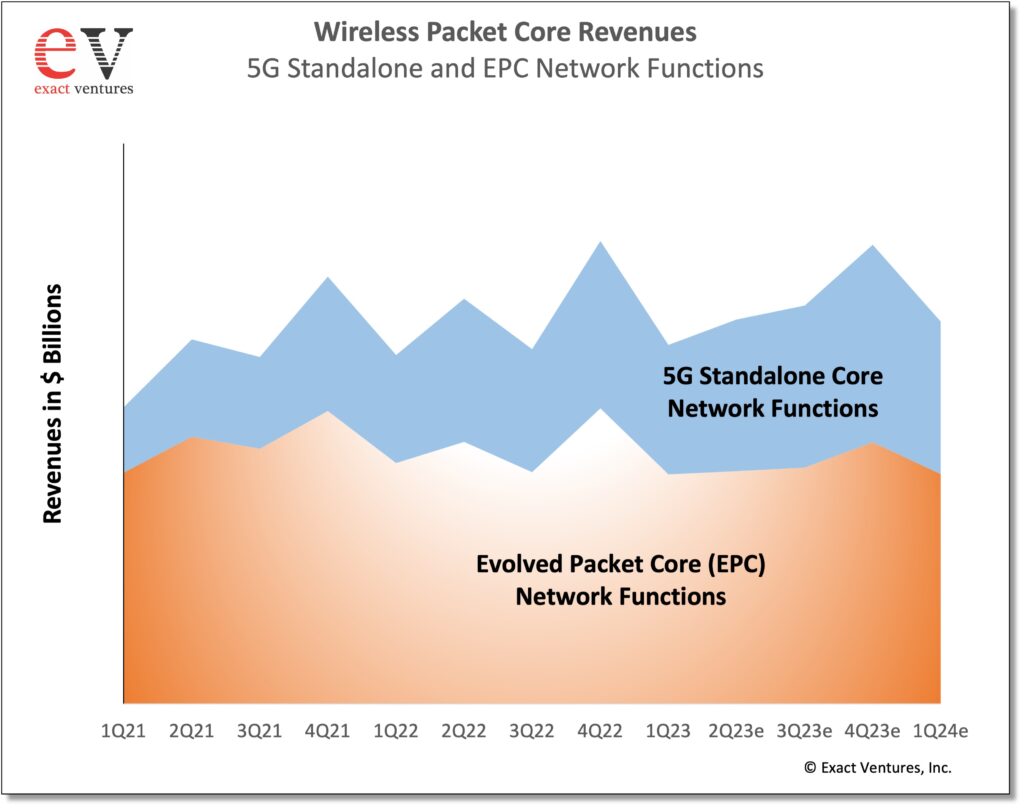

Exact Ventures recently reported that in 1Q23 the total 5G Standalone Core (5GC) and Evolved Packet Core (EPC) market fell 22% sequentially to $673 million, due to seasonality. The market was up 3% versus 1Q22, as 20% growth in 5GC revenues more than offset a 5% drop in EPC sales.

5G Standalone (SA) core networks at scale are still limited to a relatively few number of network operators, thus recognized revenues of 5G core network functions will remain volatile due to complex and stringent revenue accounting and product acceptance criteria. There has also been some delay in some 5G SA deployments due to the pandemic slowing the standards process as well as slowing the testing and trial process. Operators also continue to evaluate the use of public cloud providers and whether their own internal cloud-native environments can provide the necessary quality-of-service at an acceptable cost.

The total market rose by 9% for the full-year 2022 to nearly $3 billion as 39% growth in the 5GC market ($1.0 billion) helps to offset a 2% decline in EPC sales. EPC sales are expected to contribute approximately two-thirds of the total packet core market for the year. Operators will continue to invest in the EPC networks for many years to support 5G via NSA network architectures and to provide some level of feature parity with 5G SA based core networks and services. We did increase our 2023 forecast for EPC sales from $1.7 billion to $1.8 billion due to 5G NSA traffic growth. Regardless, overall market growth remains contingent upon growing 5GC sales. We continue to forecast that in 2023 the total market will grow 2% to $3.0 billion as 18% growth in 5GC revenues is able to offset a 7% decline in EPC sales. We expect that for the full-year 2023, 5GC revenues will account for 40% of the total market, up from 34% in 2022.

During the quarter, Huawei continued to lead the overall market with 62% share, down from 64% in 1Q22. Huawei continues to be strong in its domestic market as well as Europe, Middle East and Africa. Ericsson ended the quarter with 16% worldwide share, up from 12% in 1Q22. Nokia was the third largest vendor during the quarter followed by Mavenir and ZTE.

For more information or to purchase the report, please contact: sales@exactventures.com or call +1 650 242-0080

Get in touch